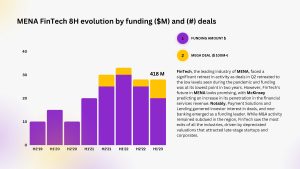

🚀 FinTech, the leading industry of MENA, faced a significant retreat in activity as deals in Q2 retreated to the low levels seen during the pandemic and funding was at its lowest point in two years. However, FinTech’s future in MENA looks promising, with McKinsey predicting an increase in its penetration in the financial services revenue. Notably, Payment Solutions and Lending garnered investor interest in deals, and neo-banking emerged as a funding leader. While M&A activity remained subdued in the region, FinTech saw the most exits of all the industries, driven by depreciated valuations that attracted late-stage startups and corporates.

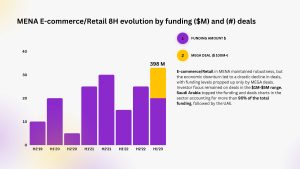

💫 E-commerce/Retail in MENA maintained robustness, but the economic downturn led to a drastic decline in deals, with funding levels propped up only by MEGA deals. Investor focus remained on deals in the $1M-$5M range. Saudi Arabia topped the funding and deals charts in the sector accounting for more than 90% of the total funding, followed by the UAE.

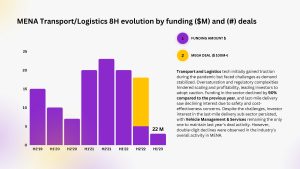

📌 Transport and Logistics tech initially gained traction during the pandemic but faced challenges as demand stabilized. Oversaturation and regulatory complexities hindered scaling and profitability, leading investors to adopt caution. Funding in the sector declined by 90% compared to the previous year, and last-mile delivery saw declining interest due to safety and cost-effectiveness concerns. Despite the challenges, investor interest in the last-mile delivery sub-sector persisted, with Vehicle Management & Services remaining the only one to maintain last year’s deal activity. However, double-digit declines were observed in the industry’s overall activity in MENA.

🔗 Full Report: https://magnitt.com/research/h1-2023-mena-industry-venture-investment-premium-report-50884